|

|

|

Now is the time to help guide your customers’ strategic equipment purchases that will maximize their Section 179 tax deduction benefits before year-end. Channel supports you with a wide variety of financing options to meet your customers’ uniquely different business needs. |

About Section 179 Benefits in 2023:

|

|

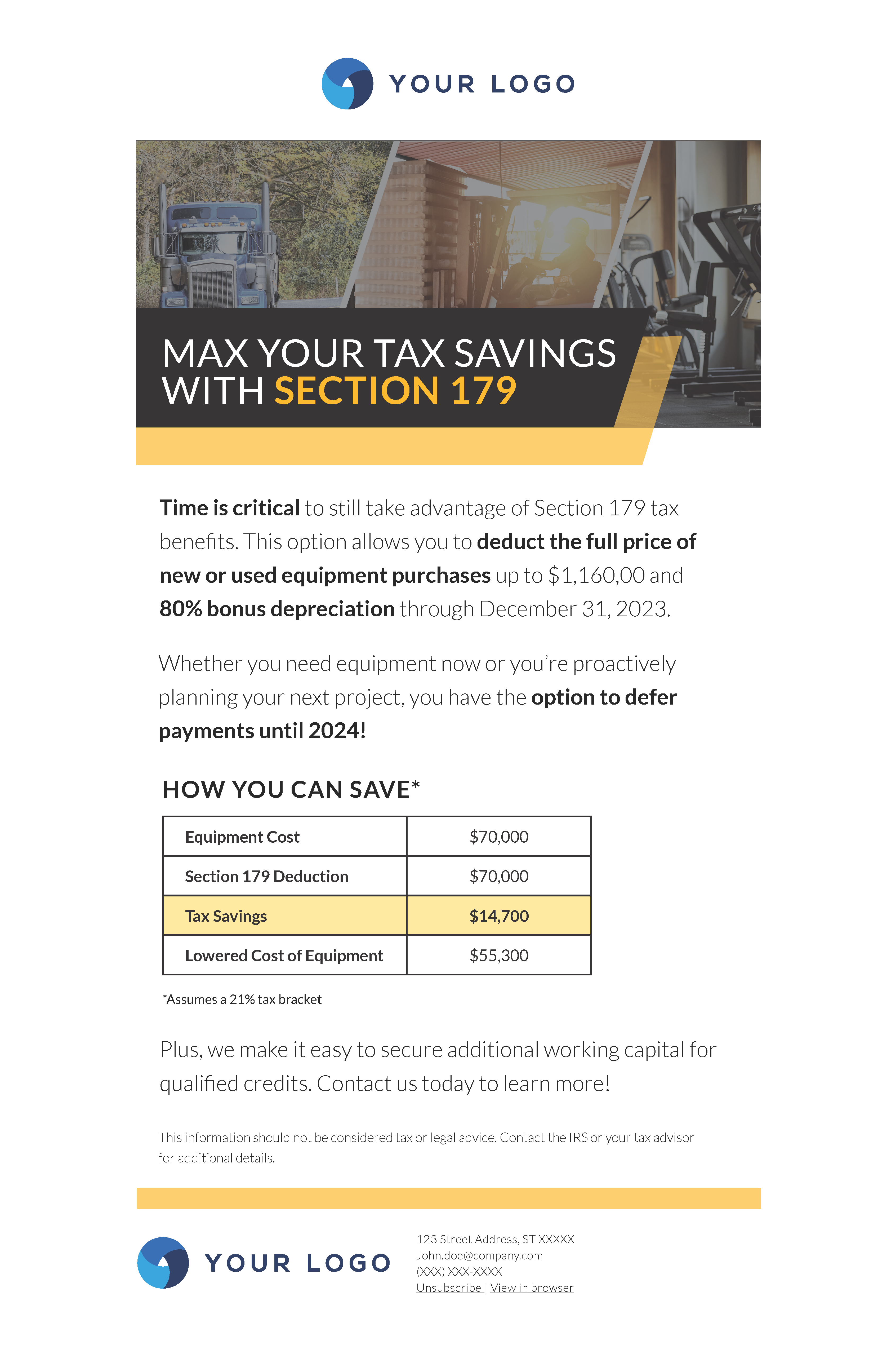

Up to 80% deduction on new and used equipment

Deduction limit $1.16M

$2.89M spending cap on equipment purchases

Payments deferred until 2024 for qualifying credits

|

|

Channel Helps you Offer More with Specialty Products:

|

|

Equipment Credit Lines (ECL): Seamlessly provide funding options that make it easy to acquire additional equipment when needed

Bundled Working Capital Approvals: Up to $50,000 working capital approvals on qualified equipment finance transactions

Channel Structured FMV: Provides your customer lower stream payments and a Structured FMV payment option

Channel MAX10 FMV: Allows your customer to renew, return or purchase equipment with an FMV not exceeding 10%

|

Our Equipment Finance Products Offer:

|

|

Risk based pricing

Financing on a variety of new and used equipment

Ticket sizes $10,000 - $250,000

Technology that puts you in control

|

Marketing Support

|

|

Our mission is to help our partners market financing solutions to their borrower customers as simply and effectively as possible. Let us do the heavy lifting and take advantage of template toolkits that guide content for flyers, HTML and text format emails, and more! |

|

| Toolkits will be provided in 5-10 business days after your order has been placed.

|

|

| For more information, contact your Channel sales representative today.

|

| This information is for reference only and not intended to provide tax or legal advice.

|

|

|

|

|

|

|

Content Options Available:

|

|

|

|

|

|

Text-Only Email Template

|

|

|

|

|

Flyer Template

|

|

|

|

|

HTML Email Template

|

|

|

|

|

×

![Plain Text Email]()